Tax Map for Rent Income Earners

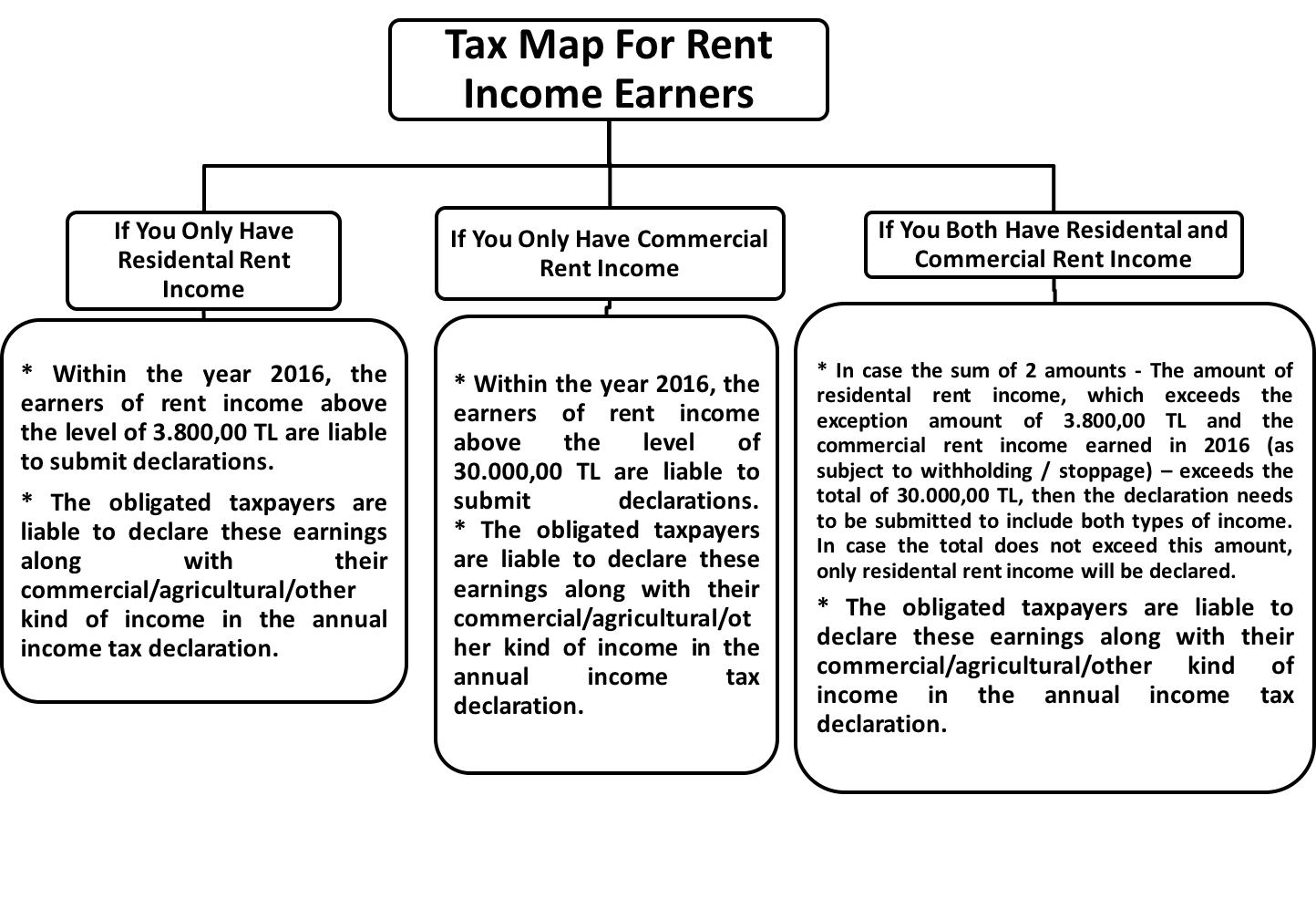

Each year, the rent income earned by real persons are declared to the respective tax office with the Annual Income Declaration until 25th of March. The types of income that are within the scope of GMSI except for the rent incomes, are stated in the Income Tax Law Number 70. In the below table only information is provided for rent income from residental and commercial places. For further detailed information please contact your customer representative or an expert.

-

-

-

Notification!