Plastic Bag Fees and Plastic Bag Declarations Are Enacted as of 2019

The new additions were made to the Law numbered 2872 through the Environmental Law and 8th clause of Law on Making Amendments in Certain Laws, which were published in the Official Gazette numbered 30621 on 10.12.2018. With the legislation, liability of collecting plastic bag fees and declaration of plastic bags has emerged.

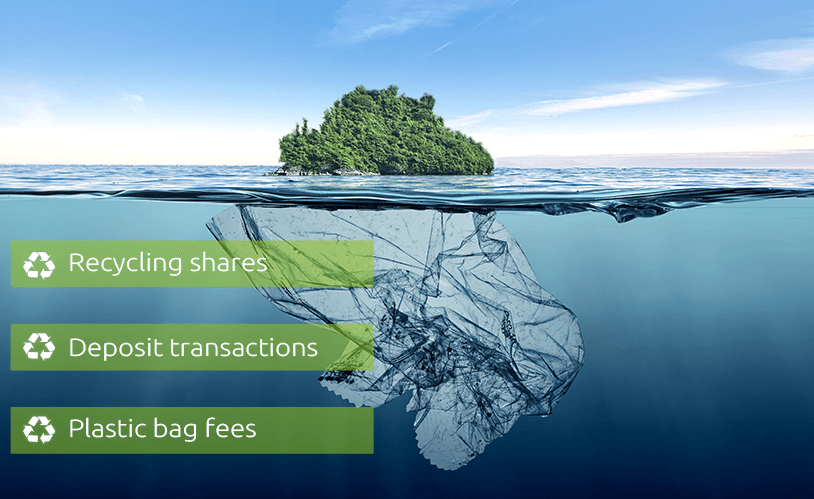

Recycling shares will be collected from selling points regarding use of plastic bags for certain products juxtaposed in the list attached to the related Law and numbered as (1); or from exporters and releasers of certain products in accordance with amounts which are stated in the list. Recycling shares will be declared to the Ministry, until the 15th day of the following month of the product release date. Until the last day of the following 2nd month of the declaration, shares are required to be paid to account of Ministry’s Central Accounting Directorate. Declared in due course of time, but unpaid recycling shares will be tracked and collected by the tax office in accordance with clauses of Law on Collection Procedure of Assets numbered 6183.

Deposit transactions are deemed mandatory within the scope of Environmental Law, from the effective date of 01.01.2021, for certain types of packaging which will be determined by the Ministry. Accordingly, selling points, who are selling packaged products subject to deposits, will be liable to participate in deposit application collection system.

Plastic bag fees will be requested from the user or consumer in order to ensure effectivity of the resources and to prevent environmental pollution. Within the scope of the Law, minimum fee will not be less than 25 cents (refer to a quarter of 1 TL) and will be determined and updated by the Ministry, annually.

You may access to the related legislation, in Turkish from here.

-

-

Notification!