08 Temmuz 2021

Details Regarding the Annual Leave

Using annual leave is a constitutional right of the employees, and the details are regulated in the Labor Law No. 4857.

As per the Article 50 of the Constitution, the right to leave is regulated as follows:

Working Conditions and Right to Rest

- Nobody can be employed in jobs that is not appropriate for their age, gender, and strength.

- Minors, women, and those with physical and mental disabilities are specially protected in terms of working conditions.

- Employees have the right to rest.

- The rights and conditions of paid weekends and holidays and paid annual leave are regulated by the Law.

The right to annual leave is regulated in the Labor Law No. 4857 as below:

When can employees be entitled to annual leave?

According to Turkish Labor Law Article 53, employees must work one full year to be eligible for annual leave.

For instance, for an employee who started to work on November 26, 2020, the annual leave entitlement date will be November 26, 2021.

The relevant Article is as below:

"Article 53 - Employees who have completed a minimum of one year of service in the establishment since their recruitment, including the trial period, shall be allowed to take paid annual leave.

The right to paid annual leave shall not be waived.

The provisions of this Act on paid annual leave do not apply to employees engaged in seasonal or other occupations lasting less than one year due to their qualifications.

The length of the employee's paid annual leave shall not be less than;

a) Fourteen days if their length of service is between one and five years (fifth year included),

b) Twenty days if it is more than five and less than fifteen years,

c) Twenty-six days if it is fifteen years and more (fifteenth year included).

For employees below the age of eighteen and above the age of fifty, the length of paid annual leave must not be less than twenty days.

The length of paid annual leave may be increased by employment contracts and collective agreements."

Do unpaid leaves postpone the entitlement date of the annual leave?

Unpaid leaves can postpone the annual leave entitlement date due to the fact that the employment contract is considered as suspended during the unpaid leave periods.

For example, if an employee whose starting date is March 20, 2020 receives an unpaid leave of 10 days later, the annual leave entitlement date will be postponed for 10 days, and that will be on March 30, 2021 instead of March 20, 2021.

How long are the annual leave periods?

According to Article 53 of Turkish Labor Law, the annual leave durations regarding the service duration (seniority) are as follows:

| Years of Service Term in the Company | Duration of Leave |

|---|---|

| 1-5 Years (including 5th year) | 14 Working Days |

| 5-15 Years (excluding 15th year) | 20 Working Days |

| 15 Years and Above | 26 Working Days |

For employees below the age of eighteen and above the age of fifty, the length of paid annual leave must not be less than 20 days. The length of paid annual leave may be increased by employment contracts and collective agreements.

Before completing the one-year working period, any annual leave used in advance by an employee will be deducted from the annual leave days that will be earned in the forthcoming year.

If there is immediate termination, annual leave wages accrued but not used by an employee are payable at termination.

Are unused annual leaves deleted, or can they be transferred to the next term?

As per the Article 50 of the Constitution and Article 53 of the Labor Law, the leaves that are not used cannot be deleted in any way, and the total unused annual leave days are transferred to the next term.

Can the employer force the employee to take annual leave?

According to Article 53 of the Law No. 4857, "annual paid leave right cannot be waived." Accordingly, employers are also responsible for using these leaves, and it is not possible for the employee to not use annual leave.

If an employee does not want to take leave although they have accumulated leave, as the employer, you can force the employee to take annual leave according to your business plans within the framework of the "management right." (It can be understood from the relevant Article of the Law that this is also an obligation for the employer).

Employees will not have the right to object in this matter. However, you can offer to use it on a different date, and if it suits you, you can agree to use it between those dates.

In addition, based on the provisions on Article 65 of the Labor Law, it can be understood that employers are obliged to use this leave. In addition, a part of the annual leave can be used in sections, not less than 10 days. However, you can freely determine the parts mutually.

Can employers offer money instead of paid annual leave, or can employees request that?

According to Article 50 of the Constitution and Article 53 of the Labor Law, it is employee's right to have rest, and therefore the leave periods cannot be converted into money and offered to the employee, or the employee cannot request money instead of annual leave time.

What will happen to the unused leaves if an employee leaves the job?

As per the Article 59 of the Labor Law, the corresponding payment amount for all unused leave should be paid to the employee upon termination.

The relevant Article is as below:

Annual leave payment upon the termination of the contract

"Article 59 – Any annual leave remuneration due to but not yet drawn by an employee must be paid to them or other persons entitled on their behalf, upon the termination of their employment contract for any reason, at the wage rate prevailing on the date of termination. Statutory limitations on such wages which have become due shall begin as of the date of the termination of the contract.

In the event that an employment contract is terminated for any reason, the employee's salaries for the annual leave periods that they have not used are paid to them or to the beneficiaries over the wage on the date of termination of the contract.

Where the employment contract has been terminated by the employer, the terms of notice prescribed in Article 17 and the leave of absence to be granted according to Article 27 for seeking new employment must not overlap with the annual leave period."

How is unused leave payment calculated?

Unused leaves are calculated over the last gross salary (premium, additional benefits, etc. are not considered).

For instance, for an employee with 6 days of unused leave;

Monthly Gross Salary = 6000 TRY

Daily Gross Salary = 6000 / 30 = 200 TRY

Gross Unused Leave Payment = 200 * 6 = 1200 TRY

SSI & Unemployment Contribution = 1200 * 15% = 180 TRY

Income Tax Base = 1200 - 180 = 1020 TRY

Income Tax = 1020 * 15% = 153 TRY

Stamp Tax = 1200 * 0.00759 = 9.11 TRY

Net Unused Leave Payment = 1200 - 180 - 153 - 9.11 = 857.89 TRY

What are the rules of annual leave payment calculation?

The rules are explained in detail on Article 57 of the Labor Law.

The relevant Article is as below:

Remuneration during annual leave

"Article 57 - Employers must pay employees using their annual leave the remuneration corresponding to their leave period either as a lump sum or as an advance payment prior to the beginning of the leave.

Provisions of Article 50 shall apply to the calculation of this remuneration. The annual leave remuneration of employees who are not paid daily, monthly, or weekly but who are remunerated according to an indefinite period of time or amount of money, such as a piece-rate, commission, profit sharing or percentage, must be calculated on their average daily earnings by dividing the total wages earned during the previous year by the number of days actually worked during that year.

If an employee has been granted a raise in pay within the previous year, the annual leave remuneration shall be calculated by dividing the total wages earned between the date of the month in which the employee uses their leave and the date when their pay was raised by the number of days worked within that period. For employees working on a percentage basis, remuneration for annual leave must be paid by the employer in addition to any amount of money derived from current percentage earnings.

Wages for weekly rest days, national and public holidays which coincide with annual leave shall be paid in addition to the annual leave pay."

In case the employee works in different workplaces which belongs to the same employer, how is the annual leave entitlement calculated?

As per the Article 54 of the Labor Law, the working periods on different workplaces which belongs to the same employer are combined and there should be no interruption between these work periods.

The relevant Article is as below:

Entitlement to paid annual leave and its application period

"Article 54 - In the calculation of the service term required to qualify for paid annual leave, the total period during which an employee has been employed in one or more establishments belonging to the same employer shall be taken into consideration. Furthermore, any length of time spent by an employee in an establishment covered by this Act plus any length of time previously spent by the same employee in an establishment belonging to the same employer but not covered by this Act shall also be considered.

If within the one-year period the employee's work is interrupted for reasons other than those enumerated in Article 55, the expiry date of the one year of service term which must have elapsed for entitlement to paid annual leave shall be shifted to the following year of service by adding additional time to compensate for the outstanding gaps caused by interruptions.

The length of the "one-year service" which must elapse for the employee's entitlement to their upcoming paid annual leave shall commence from the day on which their entitlement to their previous annual leave became effective, to be calculated towards the following year according to the subsection above and the provisions of Article 55.

The employee shall use their paid annual leave calculated for each year of service according to the subsections above and Article 55 within the following year of employment.

In calculating the service term for annual leave, account shall be taken of periods of employment in establishments belonging to the same ministry, establishments belonging to legal bodies attached to the same ministry, state economic enterprises, banks and organizations established by authorization under special laws as well as the subordinate establishments of such banks and organizations."

Which non-working periods would be considered as worked for annual leave entitlement?

On Article 55 of the Labor Law, these periods which are considered as "worked" are listed.

The relevant Article is as below:

Unworked periods treated as part of the one-year requirement to qualify for paid annual leave

"Article 55 - In determining the right to paid annual leave the periods shown below shall be treated as having been worked;

a) Days on which the employee fails to report to work owing to an accident or illness (however, time which exceeds the period foreseen in subsection I (b) of Article 25 shall not be treated as worked);

b) Days on which the female employee is not permitted to work before and after her confinement, in accordance with Article 74;

c) Days on which the employee is unable to report to work through having been called up for military exercises or for the performance of a statutory obligation, other than compulsory military service, (up to a maximum of 90 days in a year);

d) Fifteen days of any period during which the employee has not worked because of the temporary but interrupted suspension of operations for longer than one week owing to force majeure, on condition that he has subsequently resumed work;

e) Periods reckoned as having been worked, envisaged in Article 66;

f) Weekly rest days and national and public holidays;

g) Half-days of leave granted in addition to Sundays to employees working in radiological clinics, in accordance with the regulation issued under the Law No. 3153;

h) Days on which the employee is unable to report for work because of having to attend meetings of mediation and arbitration boards, acting as an employees' representative on such boards or before a labor court, serving as an employees' or union representative on boards, committees or meetings organized under the relevant legislation or attending conventions, conferences or committee meetings of international organizations dealing with labor matters;

i) In the event of the employee's marriage, adopting a child or death of the first-degree relatives (mother, father, sibling, spouse, or child) of the employee, he/she shall have three days of paid leave; and if the spouse of the employee gives birth, he/she is given five days of paid leave.

Employed parents whose child 70% of disability or more, or chronic disease based on medical health report, shall be allowed to take up to 10 days leave of absence with pay following the year of the treatment's start; on the condition of the leave may be taken by only one of the parent and shall be continuous.

j) Other leaves granted by the employer.

k) Paid annual leave granted to the employee in pursuance of the application this Law."

Can the leave periods be divided? How can we proceed with the implementation of annual leave?

On Article 56 of the Labor Law, the implementation details are explained.

The relevant Article is as below:

Implementing paid annual leave

"Article 56 - Paid annual leave may not be divided by the employer.

This leave must be granted without interruption in conformity with the days indicated in Article 53.

However, leave periods foreseen in Article 53 may be divided, by mutual consent, into three parts at the maximum, provided that one of the parts shall not be less than ten days.

Other kinds of leave, with or without pay, granted by the employer during the year or taken by the employee as convalescent or sick leave must not be deducted from annual leave.

National holidays, weekly rest days and public holidays which coincide with the duration of annual leave may not be included in the annual leave period.

If the employee so requests, the employer must grant him up to four days' leave without pay to make good their round-trip travel time, on condition that he provides documentary evidence that they are spending their annual leave at a place other than that where the establishment is located. The employer must keep a roster showing the paid annual leaves of the employees working in their establishment."

Can the employees work during annual leave period?

The employees cannot work during the annual leave period per Article 58 of the Labor Law.

The relevant Article is as below:

Restriction on working during annual leave

"Article 58 - If the employee is found to have accepted gainful employment during their annual leave, they may be asked by the employer to reimburse the annual leave remuneration already paid to them."

Is there any official publishment regulating all specific details within the workplaces?

All specific details about how the annual leave process can be handled are included in the Circular published by the Ministry per the Article 60 of the Labor Law.

The relevant Article is as below:

Regulations concerning paid annual leave

"Article 60 - A regulation indicating the methods and conditions applicable to paid annual leave, the periods within the year during which leaves will be made available according to the nature of employment, the persons authorized to decide and the order to be observed in exercising the right to leaves, the measures to be taken by the employer in order to implement annual leave in ways useful for employees as well as the form of registers to be kept by the employer shall be issued by the Ministry of Labor and Social Security."

You can access the Labor Law No. 4857 via the link. (In Turkish)

You can reach the Regulation / Circular about Annual Leave via the link. (In Turkish)

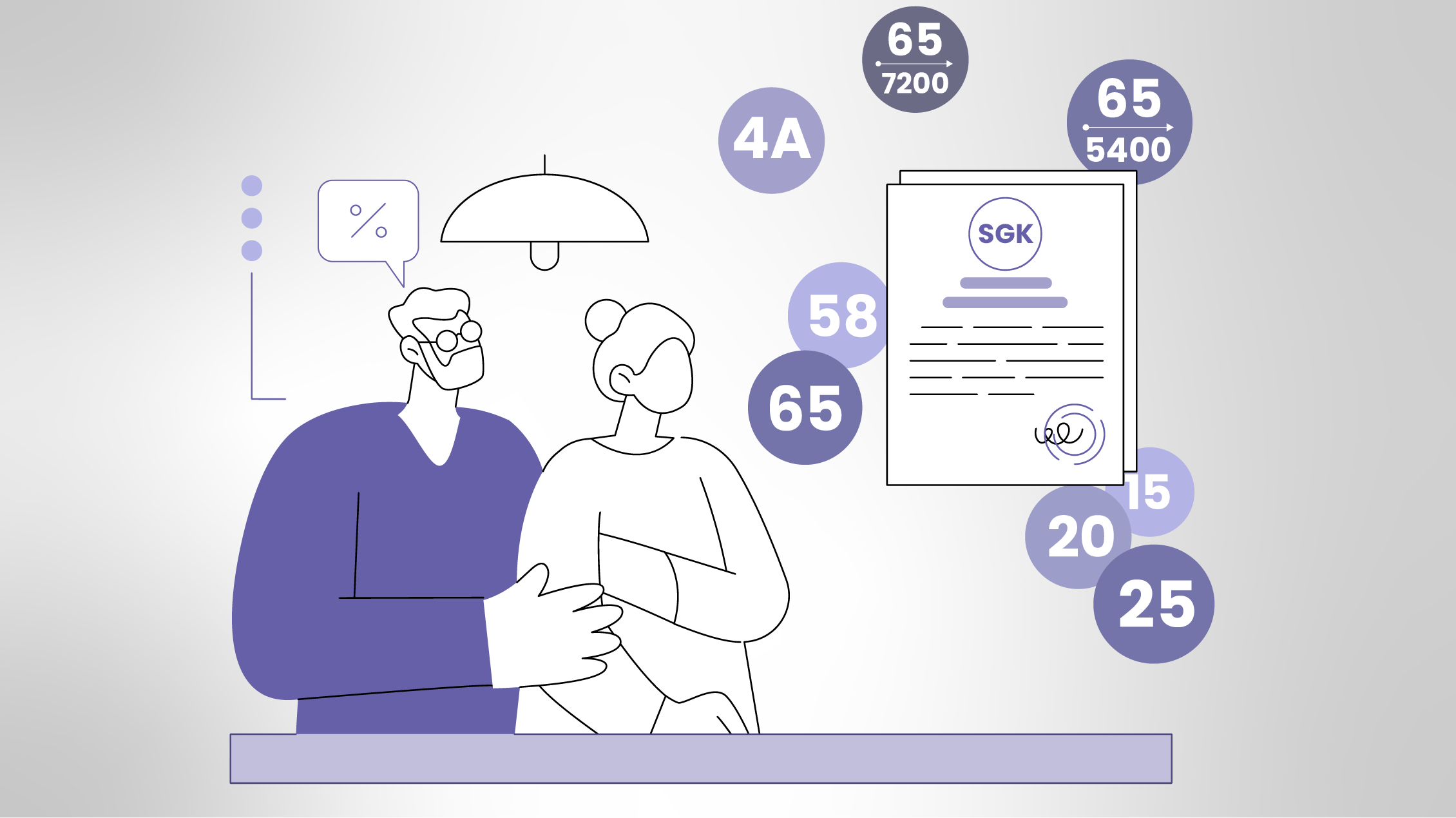

Please click here to access the infographic on the subject.

Should you have any queries or need further details, please contact your customer representative.

Notification!