Tax Map for Rent Income Earners

Each year, the rent income earned by real persons are declared to the respective tax office with the Annual Income Declaration until 31st of March, 2020. The types of income that are within the scope of GMSI except for the rent incomes, are stated in the 70th article of Income Tax Law.

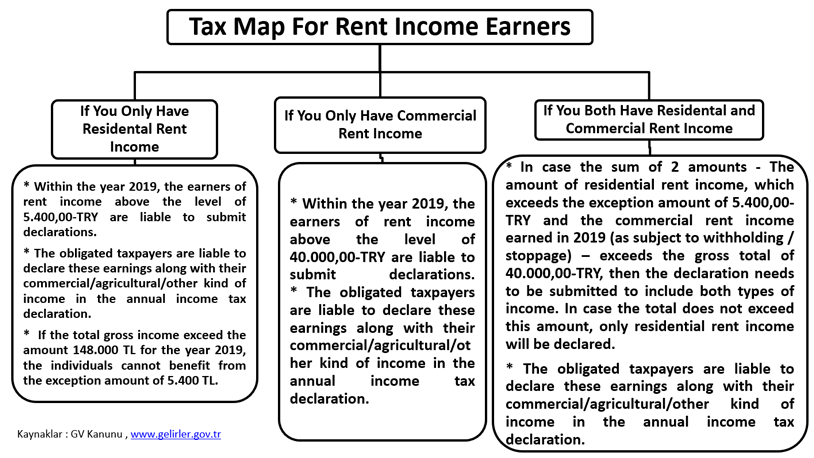

Two applications are essential in declaring rent income; lump sum expense and real expense methods. Taxpayers who choose the lump sum method can deduct the 15% of the remaining amount from real expenses after deducting the exemption from their rental income. Those who lease the rights cannot apply the lump sum method. In the table below only information is provided for rent income from residential and commercial places. For further detailed information please contact your customer representative or an expert.

The Revenue Administration has published an informative brochure in regards the tax declaration, which can be accessed in Turkish, here.

-

Tax Map For Rent Income Earners - Archive

-

-

Notification!