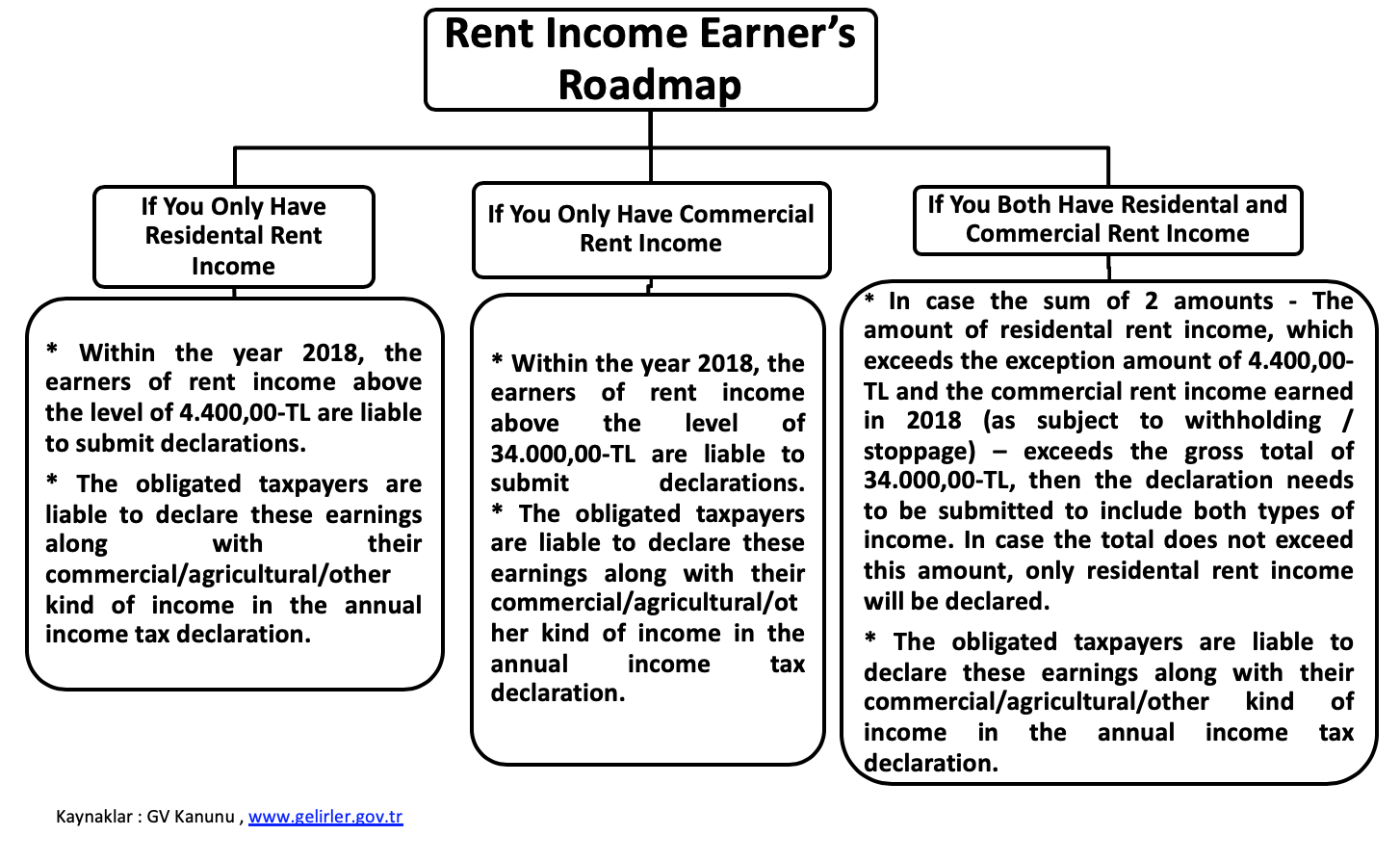

Tax Map for Rent Income Earners

Each year, the rent income earned by real persons are declared to the relevant tax office with the Annual Income Declaration by March 25. The income types which are acknowledged within the scope of the GMSI (real property income), other than the rent incomes, are elaborated on the Income Tax Law, Article 70.

The responsible party who is to apply the lump sum method, once the exemptions to be implemented on the tax can deduct the 15% rest of the amount to be declared under real expense. In the below table, you can refer to the details on rent income, applicable to residential and commercial properties. For further detailed information please contact your customer representative or an expert.

The Revenue Administration has published an informative brochure in regards the tax declaration, which can be accessed in Turkish, here.

-

Tax Map For Rent Income Earners - Archive

-

-

Notification!