Tax Map for Rent Income Earners

Each year, the rent income earned by real persons are declared to the respective tax office with the Annual Income Declaration until 25th of March. The types of income that are within the scope of GMSI except for the rent incomes, are stated in the Income Tax Law Number 70.

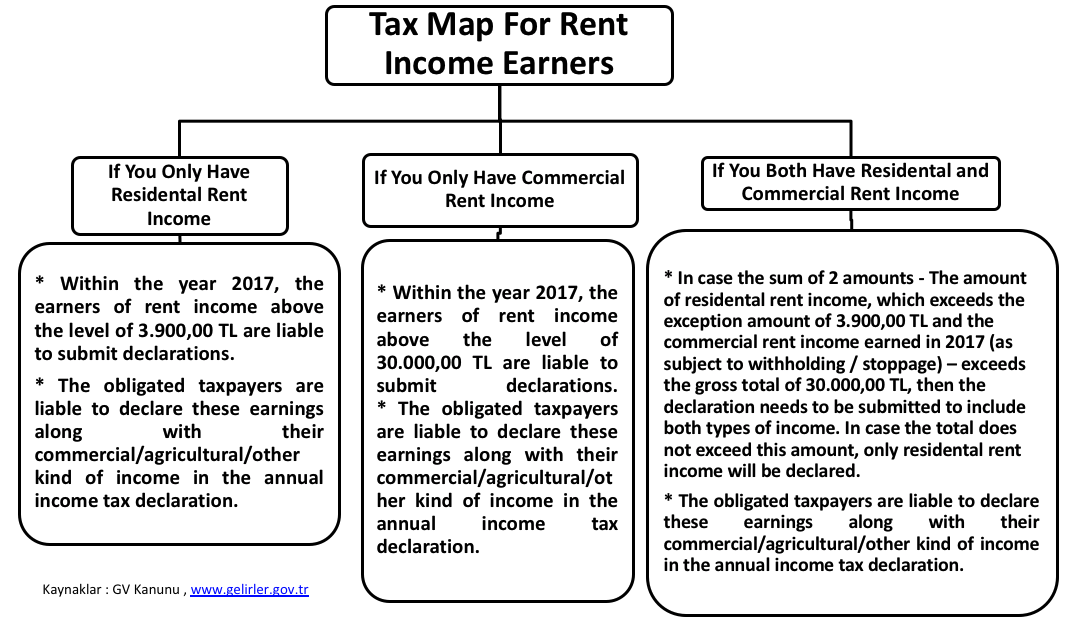

In order to declare the rent income, the lump sum expense method and real expense method are implemented. Up until this year 25% ratio was considered for implementation of lump expense method. But this 25% ratio has been reduced to 15% ratio as of the start from 2017 revenues. In the below table only information is provided for rent income from residental and commercial places. For further detailed information please contact your customer representative or an expert.

-

Tax Map For Rent Income Earners - Archive

-

-

Notification!