2024 Tax Map for Rent Income Earners

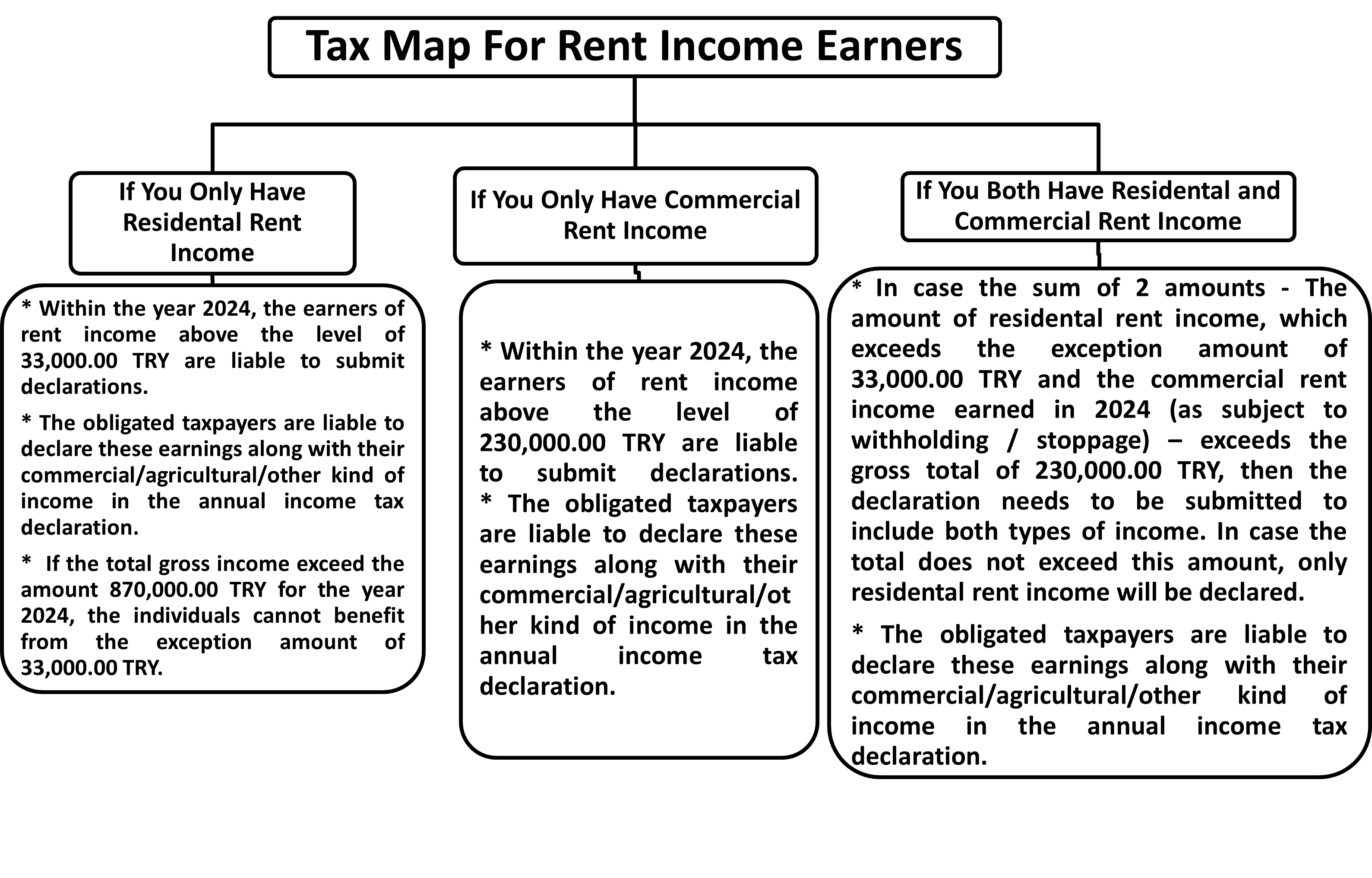

Each year, the rental income earned by real persons are declared to the respective tax office with the Annual Income Declaration until the end of March (for 2024 income, April 2, 2025). The types of income that are within the scope of immoveable assets except the rental income, are stated in the Income Tax Law Number 70. In order to declare the rent income, the lump sum expense method and actual expense method are implemented. Taxpayers who choose the lump-sum expense method can deduct the lump-sum expense of 15% of the amount remaining after deducting the exemption amount from the rental income in return for actual expenses. Those who lease the rights cannot apply the lump sum expense method. In the below table, the related details are provided for rental income from residential and commercial properties.

You can also use the Pre-filled Tax Return System (In Turkish) page of the revenue administration for the rent income declaration.

-

Tax Map For Rent Income Earners - Archive

-

-

Notification!