Who Should File an Annual Income Tax Return for the Wage Income of 2024?

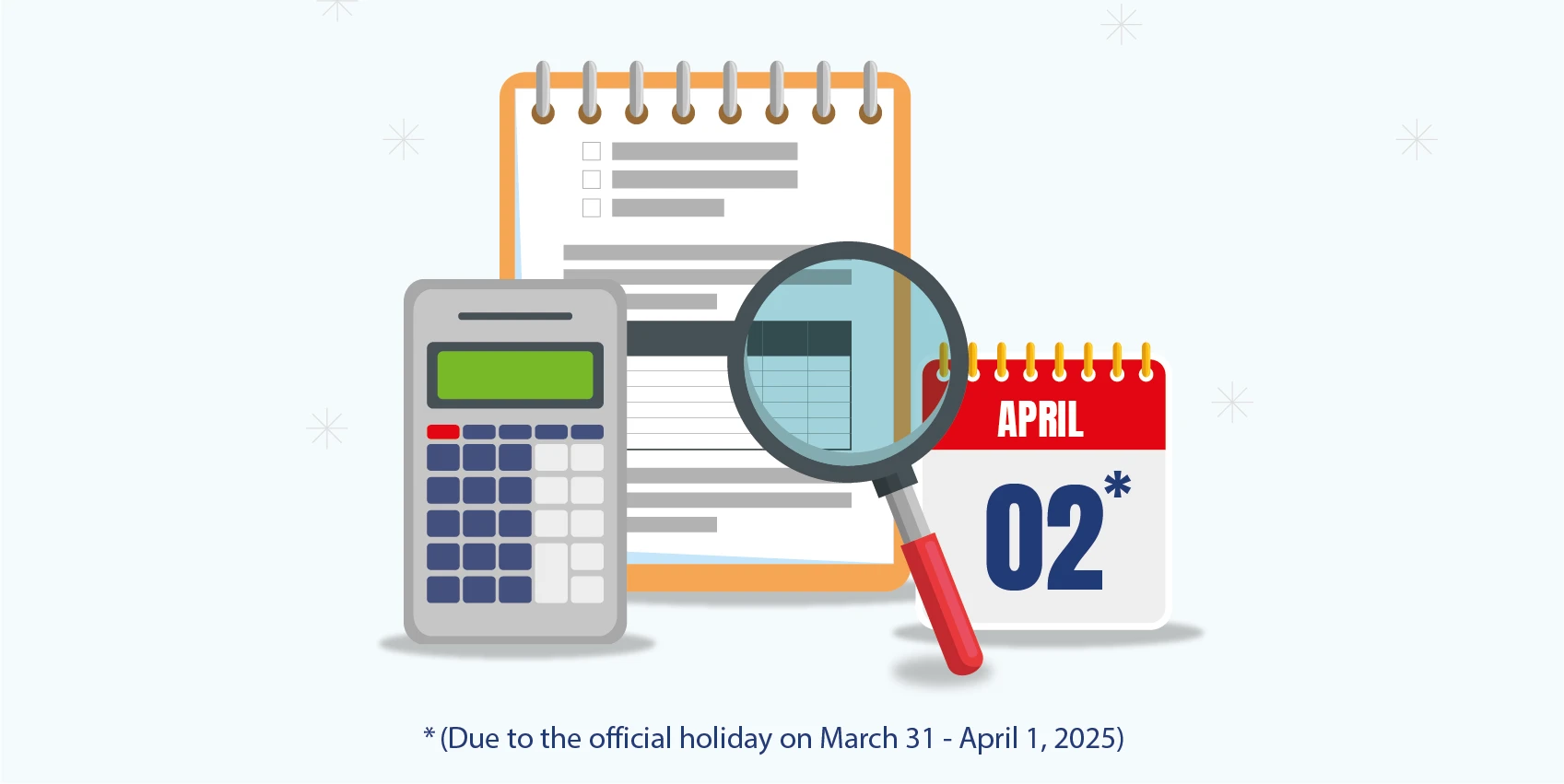

Employees who are obliged to submit annual income tax returns for 2024 tax year wages or other non-wage income (including employees working in R&D centers and technology development zones) can submit their declarations between March 1 - April 2, 2025 using the online declaration system of the Revenue Administration.

Employees can have annual income tax return obligations for their wage income under certain conditions.

In Which Cases Should Employees File an Annual Income Tax Return for 2024 Tax Year?

- Taxpayers/employees who receive wage income from a single employer, the total amount of wage income exceeds the amount in the fourth income bracket of the tariff written in Article 103 (3,000,000 TRY for 2024),

- Taxpayers/employees who receive wage income from more than one employer, including the wage income received from the first employer, exceed the amount in the fourth income bracket of the income tax tariff (3,000,000 TRY for 2024),

- Taxpayers/employees who receive wage income from more than one employer, if the total amount of wages received from more than one employer exceeds the amount in the second income bracket of the income tax tariff (230,000 TRY for 2024),

Wage income will be declared with the annual declaration.

In order to check the above limits, cumulative income tax bases should be analyzed.

How to Submit an Annual Income Tax Return?

First of all, it should be noted that the annual income tax return is the responsibility of the individuals / employees, and the employers do not have any obligations in this regard.

The Declaration system of the Revenue Administration can be accessed with e-Government password. You can find detailed information about the Declaration system by clicking the link. (In Turkish)

Declaration of Wage Income in the Online Declaration System

The declaration of wage income is detailed under the heading ‘3.3.2 3.B – THE WAGE INCOME TO BE DECLARED' in the Declaration Portal User Manual.

For 2024, you can examine the details of whether you have a declaration obligation for wage income by clicking on our link.

Should you have any queries or need further details, please contact your customer representative.

-

-

Notification!