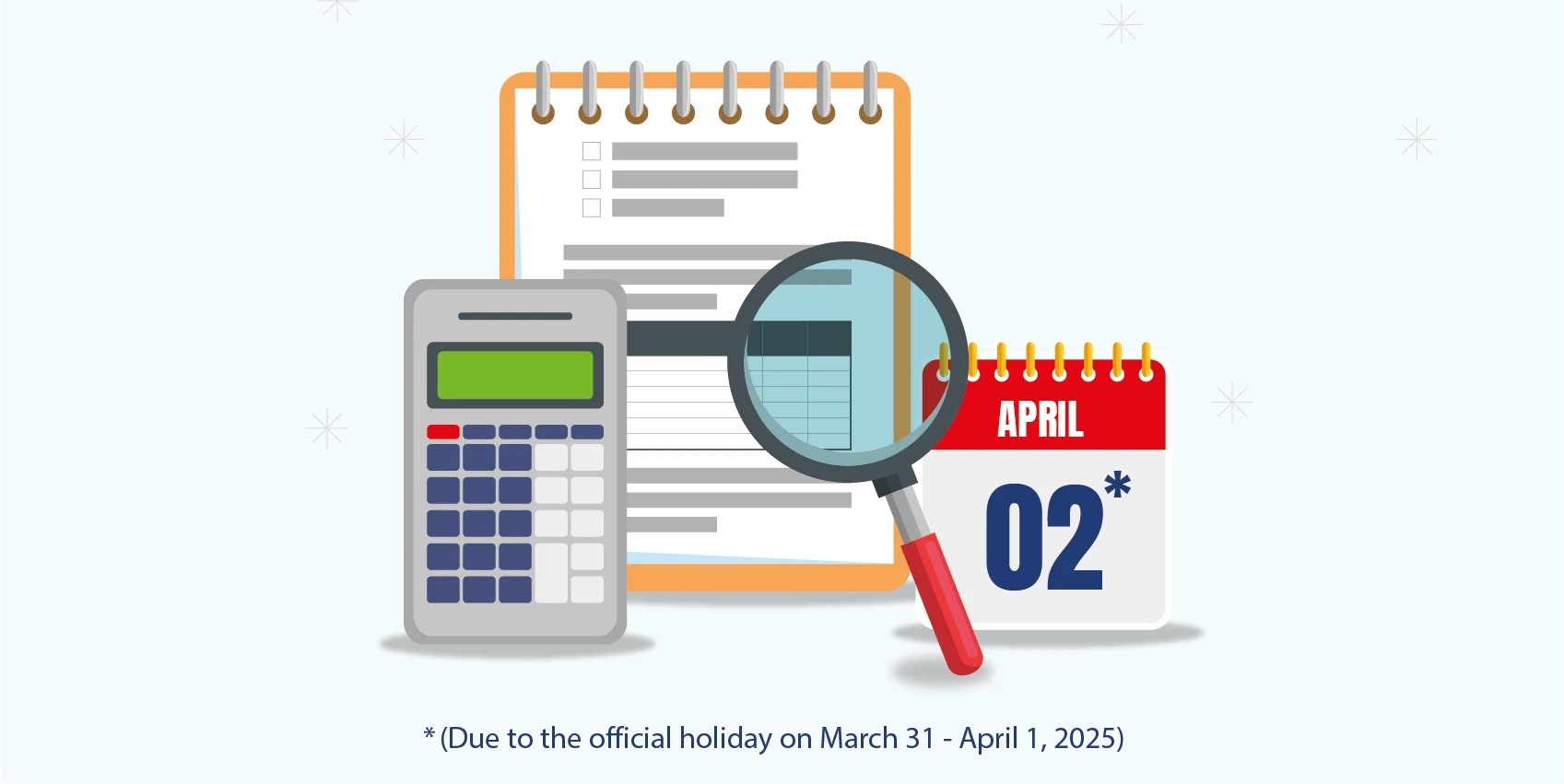

Corporate Tax Declaration, Ba Bs Form, E-Ledger Deadlines Extended

The deadlines for the submission of the Corporate Tax Declarations for the 2023 accounting period, which must be submitted by the end of April 30, 2024, and the payment periods of the taxes accrued on these declarations, and the submission of the "Form Ba-Bs" notifications for the 2024 / March period, which must be submitted by the end of April 30, 2024, and the creation and signing of the e-Ledgers that must be created and signed by the aforementioned date, and the uploading of the "Electronic Ledger Certificates" that must be uploaded to the Revenue Administration Information Processing System within the same period have been extended.

- The deadlines for filing and payment of corporate tax returns have been extended until the end of Monday, May 6, 2024.

- The Period for Submission of Notification Forms has been extended until the end of Monday, May 6, 2024.

- The Period for Creating and Signing Electronic Ledgers and the Period for Uploading Electronic Ledger Certificates has been extended until the end of Friday, May 10, 2024.

You can access the announcement of the Revenue Administration here.

Should you have any queries or need further details, please contact your customer representative

-

-

Notification!