28 March 2025

What is Withholding Tax? How to Calculate an Invoice with Withholding?

What is Withholding Tax?

Withholding tax refers to the process of partially or fully deducting and paying the tax either by the buyer or the seller, in order to ensure secure and effective tax collection. This practice is especially important in terms of Value Added Tax (VAT) and Income Tax, serving as a safeguard mechanism to prevent tax losses. Withholding the tax at its source helps the government collect tax revenues accurately and on time.

What Are the Types of Withholding Tax?

Withholding tax can be categorized into different types based on its method of application:

Income Tax Withholding

Under Article 94 of the Income Tax Law, certain types of income are subject to withholding. Examples include:

- Payroll withholding on employees' salaries

- Payments made to self-employed professionals

- Income tax withholding on rental payments

- Deductions made on agricultural products purchased from farmers

VAT Withholding

VAT withholding refers to the practice where the entirety or a portion of the VAT on certain goods and services is paid directly to the tax office by the buyer. This method is implemented to prevent tax evasion and to ensure secure tax collection.

What is Line-Based Withholding Tax?

Line-based withholding tax refers to the practice of evaluating each item or service listed on an invoice individually to determine whether it is subject to withholding tax and applying withholding tax only to the relevant lines. This method is especially important for invoices that include a mix of taxable and non-taxable items.

For example, if an invoice includes both consulting services (subject to withholding tax) and stationery products (not subject to withholding tax), withholding tax is applied only to the consulting service line. This ensures accurate VAT calculation and declaration for both the buyer and the seller.

In the e-Invoice system, there are designated fields for line-based withholding. Withholding rates are entered for each line individually, and VAT allocation is calculated accordingly. This contributes to more transparent and accurate tax declarations and accounting records.

Withholding tax is further categorized into the following:

Full Withholding Tax

Full withholding tax means that the entire tax amount is deducted by the buyer and paid directly to the tax office. It is frequently applied in payments made to foreign entities.

Main services subject to full withholding tax include:

- Services Procured from Abroad: Services such as consulting, auditing, and engineering received from entities that do not have a registered office, workplace, legal headquarters, or business center in Türkiye are subject to full withholding tax.

- Freelance Professional Services: Services provided by freelancers, particularly those involving intellectual property rights, fall under full withholding tax.

- Advertising Services: Advertising transactions are declared by the buyer under full withholding tax.

- Leasing Transactions

Partial Withholding Tax

Partial withholding tax means that a portion of the tax is declared and paid by the seller, and the remaining portion by the buyer. VAT withholding is generally applied in the form of partial withholding tax.

Which Transactions (Services) Are Subject to Withholding Tax?

Below are the main services subject to partial withholding tax and their respective withholding rates:

| Withholding Tax Transactions (Services) | Withholding Rates |

|---|---|

| Engineering, Architecture, and Survey-Project Services | 4/10 |

| Broadcasting, Advertising, and Naming Rights Revenues of Sports Clubs | 9/10 |

| Services Provided to Public Institutions | 5/10 |

| Catering and Organization Services | 5/10 |

| Consulting, Auditing, and Similar Services | 9/10 |

| Maintenance and Repair Services for Machinery, Equipment, and Vehicles | 7/10 |

| Staffing Services | 9/10 |

| Building Inspection Services | 9/10 |

| Contract Textile and Footwear Manufacturing Services | 7/10 |

| Customer Referral Services for Tourist Shops | 9/10 |

| Freight Transportation Services | 2/10 |

| Cleaning, Environmental, and Landscaping Services | 9/10 |

| Commercial Advertising Services | 3/10 |

| Shuttle Transportation Services | 5/10 |

| All Types of Printing Services | 7/10 |

| Delivery of Wood and Forest Products | 7/10 (for transactions exceeding TRY 5 million) |

| Demir-Çelik Ürünleri Teslimi | 7/10 |

These rates may vary according to the applicable legislation; therefore, it is important to follow the communiqués published by the Revenue Administration (GİB) for the most current information.

Withholding Tax Threshold for 2025

For the year 2025, the minimum threshold for VAT withholding tax has been set at TRY 9,900 (including VAT). Transactions below this amount are not subject to withholding tax. This regulation was enacted through an amendment to the Value Added Tax (VAT) General Implementation Communiqué No. 50, published in the Official Gazette dated February 10, 2024 (Issue No. 32456), and has been effective as of January 1, 2025.

What is an Invoice with Withholding?

An invoice with withholding is a special type of invoice issued for transactions subject to withholding tax. This invoice clearly states how much of the VAT will be paid by the buyer and how much will be borne by the seller.

As VAT withholding is commonly applied in services procured by public institutions, municipalities, and large enterprises, the issuance of invoices with withholding is a widespread practice. Invoices with withholding help reduce financial risk by sharing tax liability between the parties involved.

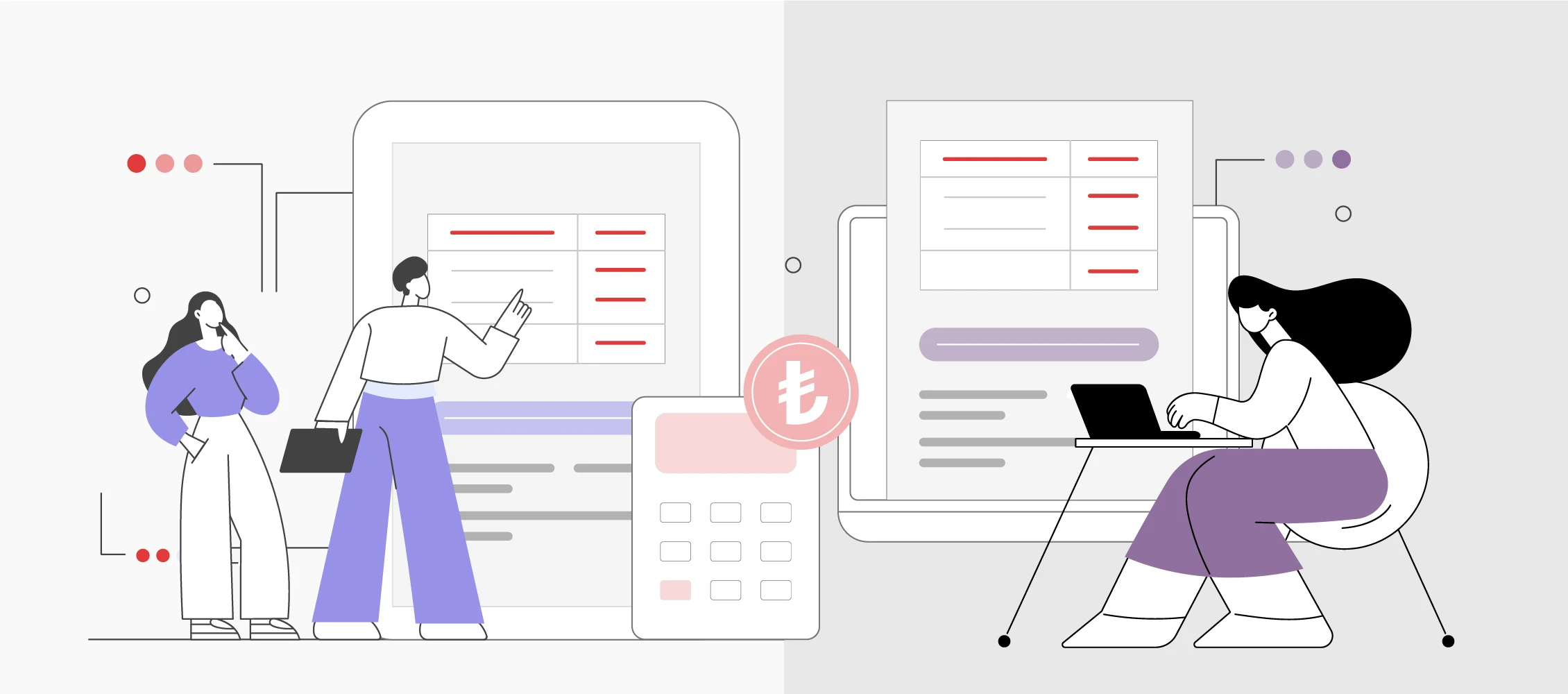

Example Calculation of an Invoice with Withholding

Here is an example of a calculation of an invoice with withholding:

- Goods/Services Amount: TRY 10,000

- VAT Rate: 20%

- Calculated VAT: TRY 10,000 × 20% = TRY 2,000

- Withholding Rate: 7/10

- Withheld VAT: TRY 2,000 × 7/10 = TRY 1,400

- VAT Payable to Seller: TRY 2,000 - TRY 1,400 = TRY 600

- Total Amount Payable: TRY 10,600

In this case:

- The buyer pays TRY 1,400 VAT directly to the tax office.

- The seller only collects TRY 600 VAT.

- The transaction must be recorded in the VAT return for the relevant period by both the buyer and the seller.

A More Complex Example:

- Service Amount: TRY 50,000

- VAT Rate: 20% → TRY 50,000 × 20% = TRY 10,000

- Withholding Rate: 9/10 → TRY 10,000 × 9/10 = TRY 9,000 (withheld VAT)

- VAT Payable to Seller: TRY 10,000 - TRY 9,000 = TRY 1,000

- Total Amount Payable: TRY 51,000

In this case, the buyer deposits TRY 9,000 VAT to the tax office on their own behalf.

How to Issue a Return for an Invoice with Withholding?

When issuing a return (credit) invoice for an invoice with withholding, the following rules must be observed:

- The invoice type must be selected as "RETURN" when issuing the credit invoice.

- The invoice must be created in accordance with the document format specified in the VAT General Implementation Communiqué.

- The return can only be applied to the portion of the invoice not subject to withholding tax.

Within this scope, manually issuing a credit invoice via the e-Invoice Portal may not be possible due to system limitations. Therefore, to process a VAT withholding tax return accurately, it is recommended to prepare the invoice through your updated accounting software that complies with the latest version and then upload it to the portal. If you are using an integration or private integration method, you can easily apply these configurations through your software and complete the return process without errors.

Who Is Obliged to Apply Withholding Tax?

Withholding tax is a mechanism where tax liability is shared between the buyer and the seller. In Türkiye, the obligation to apply VAT withholding tax is assigned to specific individuals and institutions, as defined in the VAT General Implementation Communiqué and related legislation.

- VAT Taxpayers

- Entities listed in the annexes of Law No. 5018 are required to apply for VAT withholding tax. These include:

- General budget institutions (e.g., ministries)

- Special budget institutions (e.g., universities)

- Regulatory and supervisory authorities (e.g., Capital Markets Board)

- Social security institutions

- Provincial special administrations and municipalities

- Public institutions and organizations established by law or Presidential Decree

- Revolving fund organizations

- Professional organizations with public institution status

- Banks, insurance, reinsurance, and pension companies

- Retirement and relief funds established by law or with legal entity status

- Development agencies

Conclusion

Withholding tax is a crucial practice that ensures secure tax collection and distributes tax liability between buyers and sellers. To remain compliant, it is essential to follow the latest regulations published by the Revenue Administration (GİB).

Notification!