25 February 2025

What is Inflation Accounting? How is Inflation Accounting Performed?

What is Inflation Accounting?

Inflation accounting is an accounting regulation implemented to ensure that financial statements reflect reality in high inflation environments. Since the purchasing power of money changes over time due to inflation, financial statements need to be updated. This practice is regulated under the Tax Procedure Law (VUK) and International Financial Reporting Standards (IFRS).

The primary objective of this practice is to adjust the assets, liabilities, and equity in companies' financial statements to align with current economic conditions, enabling more accurate financial analyses. The distortion in monetary items caused by high inflation makes it difficult to understand a company's true profitability and financial strength. Inflation accounting enhances the accuracy of financial statements, allowing investors, lenders, and other stakeholders to make more informed decisions.

How is Inflation Accounting Performed?

Inflation accounting involves the process of adjusting financial statements. The following steps are generally followed:

- Identification of Non-Monetary Items: Non-monetary items such as inventories, tangible and intangible fixed assets are identified.

- Calculation of the Adjustment Coefficient: The adjustment coefficient is calculated using the ratio between the price index at the acquisition date of the asset and the price index at the reporting date.

- Application of the Adjustment Process: The recorded values of non-monetary items are updated by multiplying them with the calculated adjustment coefficient.

- Reporting the Adjustment Results: The new values obtained after the adjustment process are reflected in the financial statements and used for financial reporting.

During this process, specific economic indicators such as the Domestic Producer Price Index (D-PPI) are used for calculations. Proper implementation of inflation accounting in financial reporting can improve tax planning and make financial strategies more efficient in the long run.

When is Inflation Accounting Applied?

Inflation accounting is typically applied when certain criteria are met. According to the Tax Procedure Law in Türkiye, inflation accounting must be applied if:

- The cumulative inflation rate over three years exceeds 100%, or

- The inflation rate for the last year is higher than 10%.

When these conditions are met, businesses are required to make inflation adjustments.

If these conditions are not met, companies are not obligated to apply inflation accounting. However, during periods of high inflation, some firms may voluntarily implement inflation adjustments to present more accurate financial statements.

Inflation Adjustment Implementation in Türkiye

In Türkiye, inflation accounting is carried out based on Article 298 of the Tax Procedure Law. The Domestic Producer Price Index (D-PPI), determined by the Turkish Statistical Institute (TÜİK), is the primary indicator used in inflation adjustments. Inflation accounting was first implemented in Türkiye in 2003 and 2004 and was reintroduced on January 1, 2023.

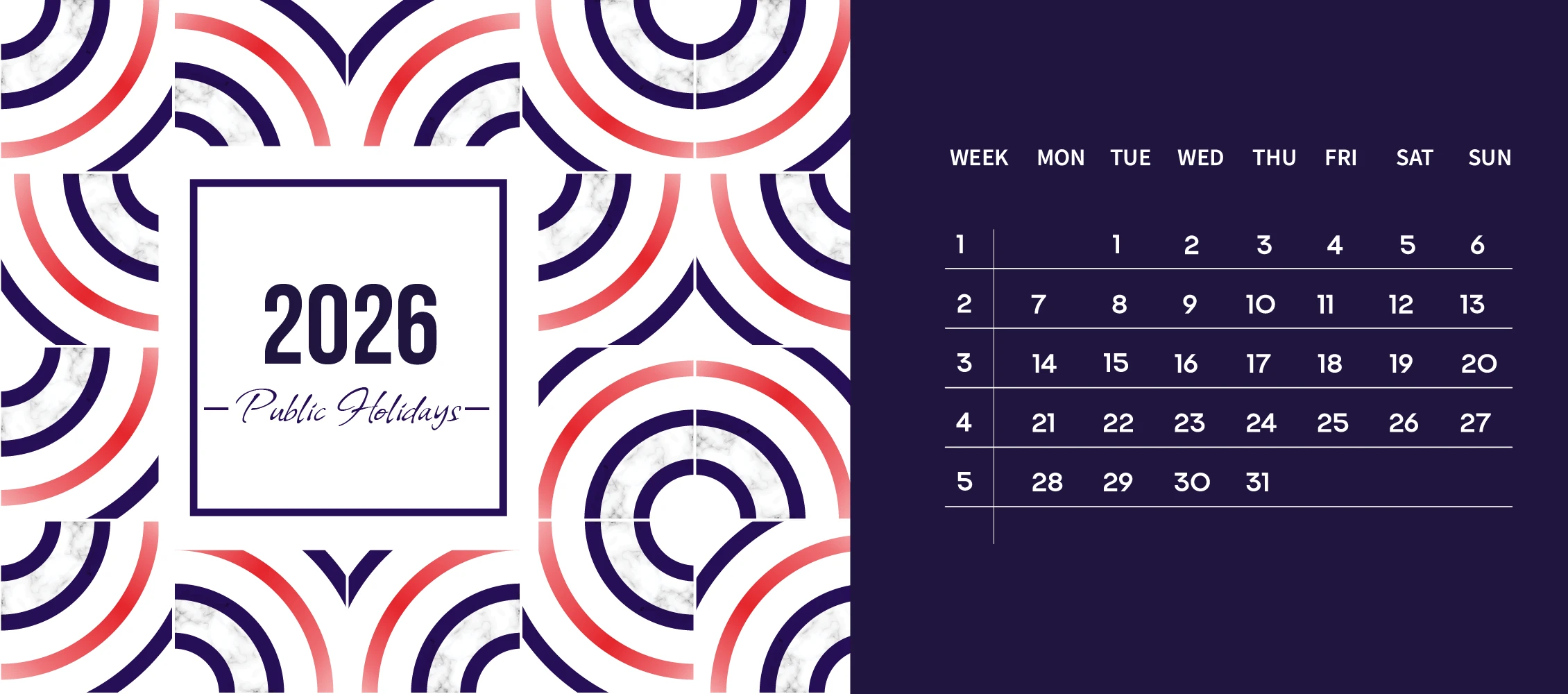

With Law No. 7571, titled "Law Amending the Turkish Penal Code and Certain Other Laws and Decree Law No. 631", which entered into force upon being published in the Official Gazette dated 25 December 2025 and numbered 33118, it has been stipulated that inflation adjustment shall not be applied in the 2025, 2026, and 2027 accounting periods.

You can access the Official Gazette regarding this matter here (In Turkish).

Who is Required to Perform Inflation Adjustments?

The following businesses are required to apply inflation accounting:

- Businesses that keep accounting records based on the balance sheet method

- Companies (Joint Stock, Limited, and other capital companies)

- Companies with public disclosure obligations

- Businesses required to apply inflation adjustments under the Tax Procedure Law

Who is Exempt from Inflation Adjustments?

Some businesses are exempt from inflation accounting. These include:

- Small businesses that keep accounting records based on the operating account method

- Self-employed professionals

- Businesses that fall within the scope of specific exemptions

Inflation Accounting Calculation

Inflation accounting calculations are performed using the Domestic Producer Price Index (D-PPI). The formula used in the calculation process is as follows:

Adjusted Value = Historical Cost × End-of-Period Index / Relevant Period Index

Example:

- A fixed asset recorded at 100,000 TRY in 2020 is adjusted using the 2023 D-PPI index.

- If the D-PPI value for 2020 is 200 and the D-PPI value for 2023 is 500, the adjusted value is calculated as follows:

100,000 × 500 / 200 = 250,000 TRY

Through this method, financial statements are adjusted to eliminate the effects of inflation, ensuring a more accurate representation of financial data.

Is Inflation Accounting Subject to Taxation?

It has been stated that the profit or loss resulting from inflation accounting may directly affect businesses' tax obligations starting from 2024 and beyond. The adjusted values in financial statements following inflation adjustments can impact a company's tax base. However, the tax implications of inflation accounting are determined by the regulations under the Tax Procedure Law.

In some cases, profits arising from inflation accounting may be subject to taxation, while certain items may benefit from exemptions or exclusions.

Whether it is subject to tax depends on factors such as the business sector, balance sheet size, and changes in financial statements. Therefore, businesses are advised to conduct a detailed analysis with their financial advisors and tax experts. Inflation accounting is a crucial practice for ensuring accurate interpretation of financial statements during high-inflation periods. By managing this process correctly, businesses can enhance their tax planning and achieve more realistic financial analysis. Proper inflation accounting practices are particularly important for long-term investment and financial decision-making.

Notification!