Meal and Heating Allowance Tax Exemptions

With the Law no:7420 published on the Official Gazette dated 9 November 2022 and numbered 32008, new regulations on Income Tax Law have been announced.

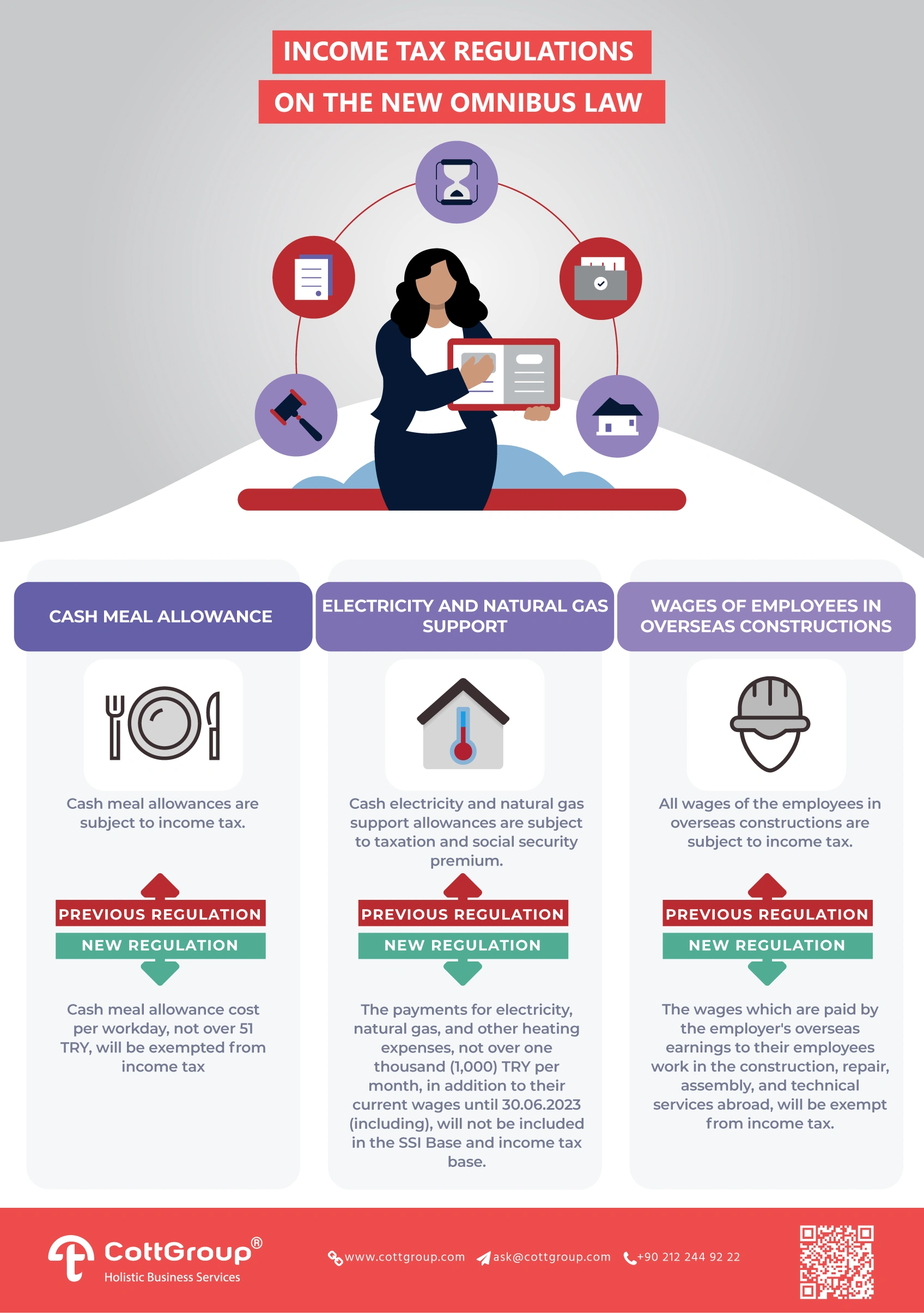

With the new Omnibus Law, cash meal allowance and heating allowance tax exemption regulations can be summarized as below:

Previous Regulation:

The below payments would be exempt from income tax:

The benefits provided by the employers should be paid to the meal service providers (catering firms) and the exemption limit would 51 TRY. In case the payment exceeds this amount, the excess amount and the cash payments made to the employees as meal cost and the benefits provided for this purpose are subject to taxation.

New Regulation:

In the case where meals are not served to the employees at the workplaces, it is expected that the cash meal allowance cost per workday, not over 51 TRY, will be exempted from income tax, and the payments over this amount and other benefits provided for this purpose will be taxed as wages.

In the case, the cash meal allowance is transferred into the bank account of the employees and these amounts are used outside of the catering services firms, it will be possible to benefit from the related exception.

The Tax and SSI Premium Exemption for Electricity and Natural Gas Support to Employees

The payments for electricity, natural gas, and other heating expenses, not over one thousand (1,000) TRY per month (for those who are over this amount, up to a thousand TRY per month), in addition to their current wages until 30.06.2023 (including), will not be included in the SSI Base and income tax base.

Tax Exemption in Wages of Employees in Overseas Constructions

With the new Omnibus Law, the payments which are paid by the employer's overseas earnings to their employees work in the construction, repair, assembly, and technical services abroad, will be exempt from income tax.

You can reach the related Law via that link (In Turkish).

Should you have any queries or need further details, please contact your customer representative.

Click on the link below to download the infographic.